With the collapse of SVB, the USDC Stablecoin and Crypto Market go Crazy

Early on Saturday, the cryptocurrency crisis reached a fever pitch as a result of Silicon Valley Bank’s (SVB) bankruptcy, which threw some of the sector’s fundamentals for a loop.

Hours after regulators closed SVB after a run on the bank, which had connections to cryptocurrency, speculators hurried to shift money around, causing stablecoin values to swing dramatically and gas costs to spike. This week, a second cryptocurrency – linked bank failed.

Top banking authorities were gathered by Treasury Secretary Janet Yellen to discuss the demise of SVB. Soon after, the crypto markets started to experience instability, indicating that the more than year-long bear market has now entered an even more depressing stage.

There are parallels of the world financial crisis of 2008, in which bad news was consistently followed by even worse news. Yet, the issue of how it will finish persists in the case of cryptocurrencies because there isn’t a central bank like the Federal Reserve that can support the sector.

The USDC stablecoin from Circle Internet Finance significantly depreciated from its target price of $1, which was a terrifying development for a product meant to be a secure storage option for investors’ funds. At 03:49 UTC on Saturday, the USDC/USDT pair, which compares Circle’s currency to the larger one produced by Tether, plunged to $0.89 on the Kraken exchange, a level it has never before reached during the market tensions that preceded the FTX fiasco in November.

The financial services giant said late on Friday that SVB was holding around $3.3 billion of the reserves supporting the second-largest stablecoin in the world.

These reserves are what give stablecoins their value; if one is worth more than $43 billion, as USDC was earlier on Friday, then there should be about that much cash or cash-like fixed-income instruments stowed away someplace to support that. The market value of USDC has now fallen below $40 billion.

However, as investors appeared to move their money away from USDC, USDT at one time rose to $1.06 on Kraken vs the US dollar, a level it seldom rarely reaches. BTC increased.

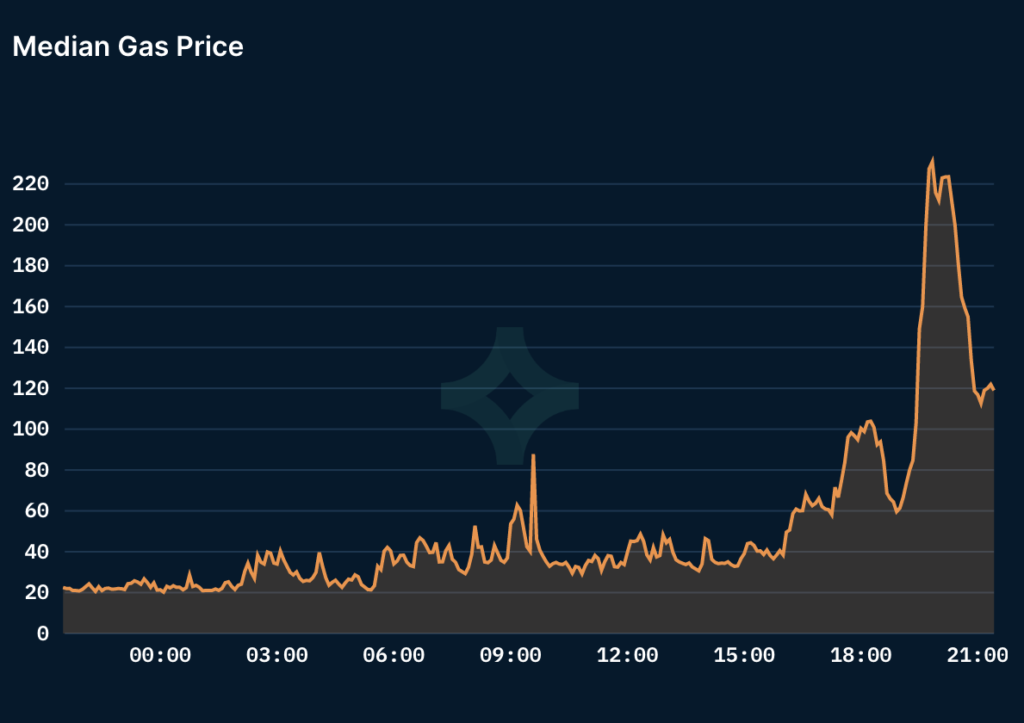

Gas fees, which reflect the price associated with completing an on-chain transaction, increased. According to Nansen.ai, the average gas charge for Ethereum increased from the 20–40 gwei range reported earlier Friday to as much as 231 gwei.

In the wake of the 2008 financial crisis — and, some would argue, in response to it — crypto was created. In a world where governments have just supported the financial system by pumping money into it, Satoshi Nakamoto’s Bitcoin paper made its appearance. Cryptocurrency lacks a similar centralized power. The consequences remain unknown if SVB clients, including Circle and its USDC stablecoin, are required to take a financial hit.

Who will then intervene, if anyone?

Elon Musk, the billionaire, said, “I’m open to the concept,” in response to Razer CEO Min-Liang Tan’s late-Friday tweet suggesting that Twitter purchase SVB and transform into a digital bank.