Deutsche Bank has Agreed to Pay the Jeffrey Epstein Victims $75 Million

According to sources speaking to CNBC on Wednesday night, Deutsche Bank has settled a federal lawsuit accusing it of facilitating and profiting from its customer’s sex trafficking of young women by agreeing to pay $75 million to victims of sexual predator Jeffrey Epstein.

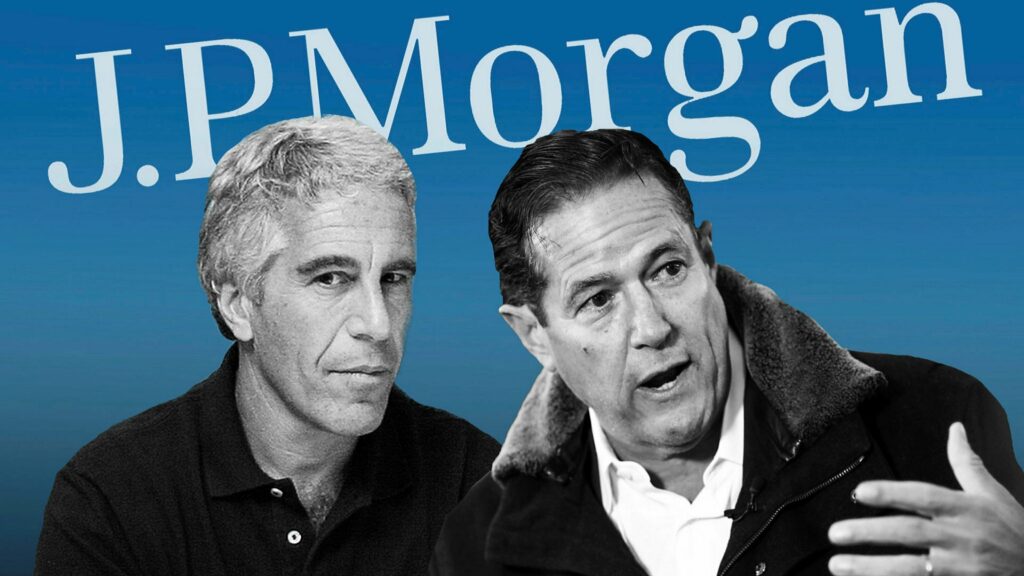

The surprise arrangement still leaves JPMorgan Chase to defend its own potential class action case brought by Epstein accusers in U.S. District Court in Manhattan that contains comparable accusations.

In that lawsuit as well as one connected to it brought by the government of the U.S. Virgin Islands, JPMorgan CEO Jamie Dimon, who has stated the bank is not responsible for sex trafficking by its former long-time customer Epstein, is scheduled to give a deposition on May 26.

The Wall Street Journal was the first to report on the settlement deal with Deutsche Bank, which would reserve $75 million for Epstein accusers.

According to the agreement, victims of Epstein’s sex trafficking who suffered during the years that he was a client of Deutsche Bank, from 2013 to 2018, would receive a minimum of $75,000 and a maximum of $5 million, based on the assessment of their claims.

Dylan Riddle, a spokesperson for Deutsche firm, declined to comment on the transaction but pointed out that his firm had invested more than 4 billion euros ($4.34 billion) in improving internal financial controls.

According to Riddle, Deutsche Bank has improved significantly over the past few years in addressing a number of old problems.

He mentioned that Deutsche Bank had stated, “We acknowledge our error onboarding Epstein in 2013, and the weaknesses in our processes, and have learned from our mistakes and our shortcomings,” in 2020, when the bank agreed to pay a $150 million fine to New York’s financial regulator for its dealings with Epstein and other issues.

“This groundbreaking settlement is the culmination of two law firms conducting more than a decade-long investigation to hold one of Epstein’s financial banking partners accountable for the role it played in facilitating his trafficking organization,” the two law firms representing the accusers, Edwards Pottinger and Boies Schiller Flexner, said in a joint statement obtained by CNBC.

A woman going by the name Jane Doe filed the lawsuit in November and requested class-action status. She said that by “providing the necessary financial support for the continued operation” of that scam, Deutsche Bank knew about and profited financially from its involvement in Epstein’s sex trafficking.

“Deutsche Bank also knew that Epstein would use means of force, threats of force, fraud, abuse of legal process, exploitation of power disparity, and a variety of other forms of coercion to cause young women and girls to engage in commercial sex acts,” the lawsuit claims.

The lawsuit claimed that Deutsche Bank decided to prioritize profit over upholding the law because it knew it would benefit financially from helping Epstein engage in sex trafficking and from its relationship with Epstein. In order to maximize earnings, Deutsche Bank specifically decided to assist a sex trafficking business.

After JPMorgan discontinued its banking arrangement with Epstein, who had been a customer of theirs from 1998 until 2013, he switched to Deutsche Bank.

According to the lawsuit, Deutsche Bank “picked up exactly where JPMorgan left off” and became into the bank that Epstein required in order to finance his sex abuse and sex trafficking business.

In August 2019, one month after being detained on federal allegations of child sex trafficking, Epstein committed suicide in a federal prison in Manhattan.

Ten years prior to his arrest in that case, he had pleaded guilty in a Florida state court to soliciting sex from an underage girl in exchange for payment. He had served more than a year in jail at that point. 2008’s guilty plea received a lot of media attention.