60% of Americans struggle to make ends meet

Consumers are still spending despite increasing costs, but less than they were a year ago, which gives their budgets some breathing room.

According to a recent LendingClub research, 45% of high-income earners and 60% of all U.S. individuals were living paycheck to paycheck as of January. This has decreased from 64% a year ago, indicating that some customers’ financial conditions have improved as a result of last year’s spending restraints.

Consumers are actively changing their behavior to adjust their spending and better manage their cash flow, especially during the holiday shopping season in 2022, according to Anuj Nayar, financial health officer at LendingClub. “Consumers have accepted that inflation is part of their everyday lives,” he said.

Yet, the most recent inflation data from the core personal consumer expenditures index from last Friday was higher than anticipated, demonstrating that certain spending patterns are difficult to change. Compared to the projection of 1.4%, consumer expenditure increased by 1.8% for the month.

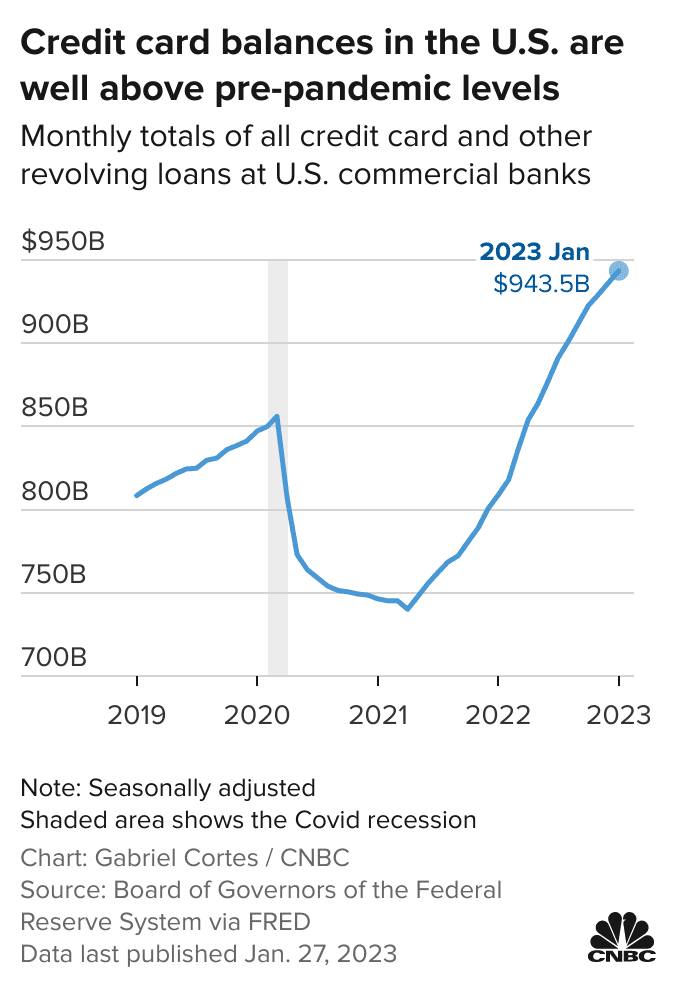

According to a different Bankrate.com research, over half, or 46%, of credit card users now carry debt from month to month on at least one card, up from 39% last year.

According to Ted Rossman, senior industry analyst at Bankrate, “spending part of your tax return money to pay down this high-cost debt would be a smart decision” if you have credit card debt, which more than a third of Americans have.

Ways to strengthen your financial situation

Ted Jenkin, a certified financial planner and member of CNBC’s Financial Adviser Council, is the CEO and founder of oXYGen Financial in Atlanta and gives more advice on how to cut costs and increase savings.

1. Spend less

Jenkin suggested some easy money-saving tips, such limiting internet buying and grocery store visits.

Grocery shops, like Las Vegas, exist to keep you away from your pocketbook, he claimed. One approach to reduce your grocery list to the necessities for the week and save money is via meal planning.

It may also be beneficial to disable one-click ordering or remove credit card data that has been saved. Anybody who uses a stored credit card to make purchases on Amazon is essentially throwing lighter fluid on their budget, according to Jenkin.

Before making an online purchase, Jenkin advises waiting 24 hours and utilizing a price-tracking browser plugin like CamelCamelCamel or Keepa to discover the best deal.

Lastly, pay with a cash-back card like the Citi Double Cash Card, which will reward you 2%, and use a savings tool like Cently, which automatically applies a discount code to your online buy.

You must exercise discipline or you will outspend your money, he warned.

2. Increase savings

Your savings should also be advantageous to you, according to Jenkin.

Even a high-yield savings account won’t pay enough to keep up with the growing cost of living, despite the fact that deposit rates are rising.

To guarantee you receive the greatest yields, Jenkin advises purchasing short-term, relatively risk-free Treasury bonds and laddering them, which involves keeping bonds until the end of their terms.

Even though the return was modest, he assured the investor that they would not lose money.

Federal I bonds, which are assets that are almost risk-free and inflation-protected, offer a different choice.

In contrast to the 9.62% annual rate that was available from May through October 2022, I bonds are presently paying 6.89% annual interest on new purchases through April.

Nonetheless, for long-term savers, this will function effectively as a protection against inflation. The drawbacks include a one-year redemption period and paying the final three months of interest if bonds are redeemed before five years.

The paycheck-to-paycheck analysis from LendingClub is based on a January poll of more than 4,000 U.S. individuals.